Why Financial Literacy is So Important for Teachers

There are many reasons why teachers should take an interest in financial literacy that go beyond providing student instruction. Here are a few:

Teachers play a critical role in society.

According to the DOE, almost 50% of new teachers leave the profession within

In the first 5 years, many cited financial concerns. If teachers can feel more financially secure and prosperous, it will lead to greater retention of great teaching talent and experience.

Teachers serve as role models to students.

Through their influence, teachers can help students develop healthy financial habits that can benefit students greatly. Much about financial literacy is a mindset, and this can impact how you communicate this positive, growth, and abundance mindset to your students, even if students are not specifically learning about financial literacy themselves.

The less teachers worry about financial stress, the better a teacher can focus on their students.

We have all experienced the anxiety and stress of financial hardship and uncertainty. Often, it is impossible not to allow it to interfere with other parts of our lives. By having a strong financial plan built on financial literacy, teachers have a better chance of not allowing finances to interfere with their classroom performance. Leaving them with the mental bandwidth to focus on student achievement.

Teachers have great circumstances to be able to take advantage of financial improvement opportunities.

Our society values and appreciates the teaching profession greatly. We understand what an important role teachers have in shaping our future. Because of this, society has created many opportunities for educators to take advantage of to help them in their success that are not available to many in the general public. From discounts to grants to teacher-specialized retirement programs, with the right financial skill set, teachers are in a great position to take advantage of many of these opportunities.

The Good News: Professional & Financial Advantages Teachers Have

In addition to the personal satisfaction, community, and cultural benefits of the teaching profession, many factors put teachers in a great position to be successful financially. These include the following:

Job Stability: Education offers stable employment, especially in high-demand areas. Schools are major employers in most states, ensuring job security. Unlike other industries prone to layoffs or industries that can suffer periods of unemployment, public school teachers benefit from union agreements, government funding, and common teacher shortages, further enhancing stability.

Career Growth Opportunities: Despite being underpaid, teachers still earn about 11% more than the average professional worker, benefiting from job stability and career growth. The profession offers advancement opportunities in leadership, curriculum development, and subject specialization, leading to salary increases. States and districts also offer pathways for salary improvement through continuing education. Teacher salary growth rates currently surpass those of other professions, and with increased awareness of the pay gap, teacher salaries are expected to rise further.

A Schedule that Allows for Additional Financial Pursuits: While teachers work very hard and long hours during the normal school year, most K-12 educators have above-average time outside of work, including holidays and summer breaks. This provides a great opportunity for teachers to pursue additional interests. In addition to personal time, teachers can use this time to put their skill sets to work doing additional school-related or non-school-related activities that can supplement their regular salaries, if they choose.

Unique Retirement Saving & Benefits Options: When it comes to retirement savings and benefits, teachers have a great deal in comparison to most professions. Most teachers have multiple options to save for retirement, including a pension plan and supplemental contribution plans such as a 403(b). With a plan and a financially literate mindset, most teachers are in a great position to create a financial plan for success in retirement and other pursuits. In addition, there are many advantages to the teaching profession, ranging from discounts and perks only for teachers to loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) and the Teacher Loan Forgiveness Program, which are available only to teachers.

Transferable Skills: The teaching profession requires a great mix of skills to be effective. Teachers can leverage their skill set to boost their financial opportunities in various ways. Transferable skills like communication, organization, problem-solving, and adaptability are highly sought after across industries. These can include opportunities to do tutoring/coaching, curriculum development, consulting, freelance writing, summertime work, or corporate training, just to name a few. Teachers can use these widely sought-after skills paired with time off, such as summertime to increase their earning potential greatly.

A Natural Talent and Love of Learning: One of the most important factors in financial literacy and success is a love of learning. Teachers are natural learners with an above-average sense of curiosity. When you enjoy learning, you’re more inclined to explore complex topics like budgeting, investing, saving, and managing debt. This curiosity can drive you to seek out resources such as books, courses, or resources that deepen your understanding of personal finance leading to greater success.

Teacher wellness

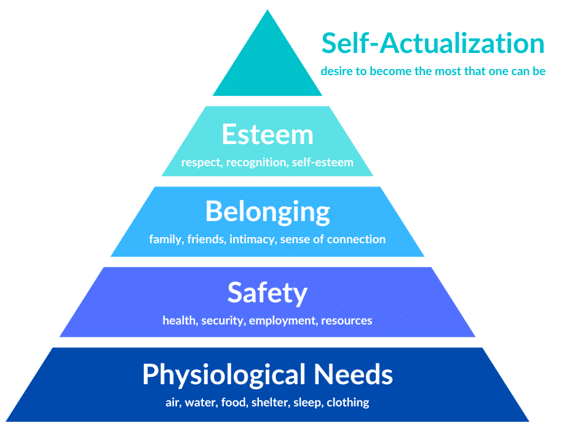

Maslow’s Hierarchy of Needs

Moreover, financial health influences higher-level needs such as self-actualization and esteem. It provides the freedom to engage in enriching experiences and the support of loved ones, enhancing personal fulfillment. Educators, often preoccupied with their students’ needs, may neglect their financial health, which is vital for their own well-being.

Know Your Financial IQ: The success Mindsets of the Financially intelligent.

There are five critical success mindsets of the financially intelligent:

- Self-control and delayed gratification. Financially intelligent individuals put procedures in place to delay gratification to reap the rewards of their financial decisions in retirement.

- Understanding wants vs. needs. These individuals deeply analyze aspects of their lives that are wants versus needs and plan to limit the “wants” in day-to-day spending decisions.

- Plan-oriented, with long- and short-term goals. Financially intelligent individuals are often goal-oriented, ensuring they are more likely to experience success in long-term financial planning.

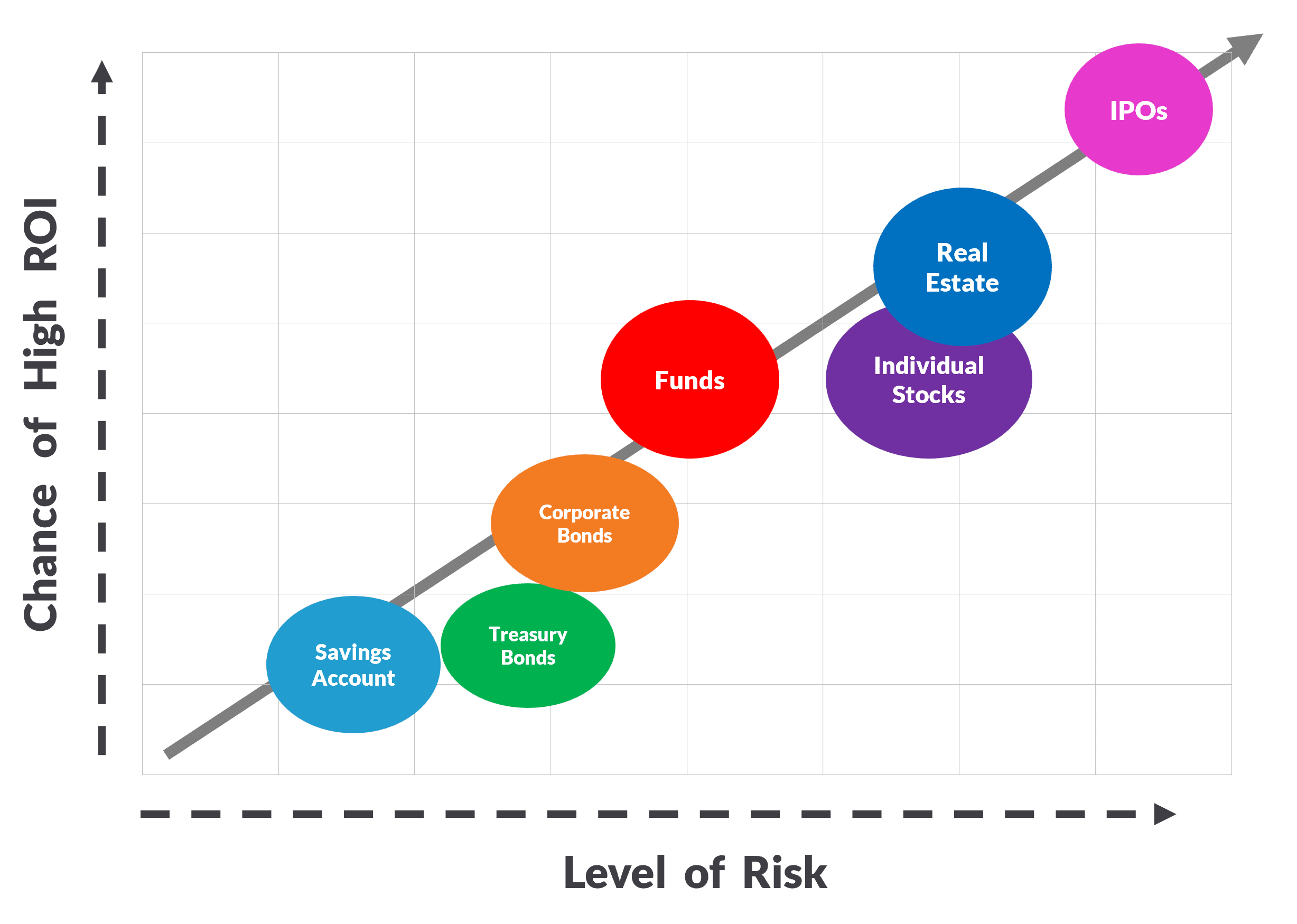

- Understanding risk vs. reward. Understanding the balance between risk and reward helps financially intelligent individuals make the right choices for their financial future.

- Emotional resilience and grit. Working on strategies to manage and persevere through stress and roadblocks that occur in life helps set financially intelligent individuals up for long-term success.

You might think these elements are critical to success in any endeavor, and you would be correct! From running a marathon, parenting, obtaining an advanced degree, and financially planning for your future, each of these five mindsets is a characteristic of success.

What Should Teachers Know In Order to Achieve Financial Success

Understand Cashflow / Money Management

Managing Cash flow

The movement of money in and out of your accounts over time. For example, your income, spending, saving, and hopefully investing.

Budgeting

The plan you have for your cash flow. This is an actual recorded document that is prepared before the money moves under your management. It provides intention to your cash flow and as we will see, is the core of your financial plan. In this section, we will discuss how to build and execute on a budget using various techniques.

So, what is a budget?

A budget is a well-thought-out, pre-determined, written plan for expected income. It is more than just a preference for how you plan to spend your money for the month; it is an actual document, spreadsheet, or software application that has been completed and is based on prior spending habits and projected future income. Your budget should also be designed to have a surplus of income, or at least break even, after its defined time period.

Notably, a budget should also include a system (like the envelope system) you can use to help you keep track of the different categories of expenses, helping you keep track of the money allocated for each area for which you plan to spend money.

Creating a Cash Buffer for Emergencies

An emergency fund is one of the first tasks of building your financial plan.

What it does: An emergency fund helps cover unexpected expenses and provides financial security during emergencies. This will keep you from turning to debt instruments like credit cards and will allow you to stick to your financial goals with limited lifestyle disruption. It will be important only to use the fund during legitimate emergencies and to re-fund it quickly if it is ever used!

What funds and how much: Your emergency fund should be put into cash instruments or savings, not at risk of investment loss. Try to earn basic interest to avoid erosion from inflation (discussed later), but protect it from investment loss. It should only be used in legitimate emergencies, and is somewhat difficult to access, helping you to avoid impulse purchases. The fund size should be anywhere from 3 to 6 months of total expenses based on your budget and risk tolerance.

Examples of Bad Debt Instruments:

Credit cards – Credit cards are considered bad debt instruments because they often have very high interest rates and are highly accessible- anybody can apply for multiple credit cards. They can be used to purchase anything at almost any location, and it can be very hard to track the accumulation of debt.

Payday loans – Payday loans have exceptionally high interest, often almost doubling the amount needed for repayment, and can lead to a cycle of dependency, robbing debtors of their source of income.

Car loans – Car loans can be considered bad debt if they include: 1. Higher than normal interest rates, 2. overleveraged in the length of the term and amount of monthly payments, usually due to purchasing too expensive of a car, or 3. are unnecessary, as in an extra vehicle that is not required for transportation needs.

What Factors Make Bad Debt “Bad”?

- High interest rates

- Contribute to a reliance as they are often used to supplement income with debt. Can create a feedback loop of dependency

- Often, they are not tied to any upside or valuable tangible property (ex, owning a house or car, or getting an education)

- Considered predatory and often highly regulated by laws, Collection efforts can often be aggressive and traumatic on the debtor

- Too easy to obtain makes “reaching for” too easy, and on impulse

- Limited checks in place for credit history or creditworthiness to obtain

- No asset backing, such as a house or property, and a high collection probability can harm credit scores

Consider a debt management strategy:

The Debt Snowball

How it works

- Budget to pay off your smallest debt as quickly as possible. This could be a credit card, a bank loan, or a car loan. Do this while making minimum payments on all other debts you owe.

- Once paid off, take the money you had been paying on that first debt and contribute that (along with your minimum payment due) on your next largest debt.

- Then repeat this as you move up your debts. You will notice that your overall monthly debt payment across all debts does not change as you pay off each debt individually.

Why it works: This method works because it keeps your overall debt payment steady as you pay off each debt individually. Paying and eliminating each debt, then rolling that freed-up money into the next debt, prevents you from using that extra money elsewhere in your budget but rather on the next debt, accelerating debt reduction. It also provides great motivation as you can start to see “wins” as you pay off each small debt one by one before moving to larger debts, like a snowball.

Things to consider: While this method is excellent for debt reduction and keeping you motivated, you may end up paying more interest overall on some of your larger accounts as you pay off the smaller ones.

The Avalanche Method

How it works:

- Budget to pay off your debt with the highest interest rate (APR) as quickly as possible, this could be a credit card, a bank loan, or a car loan. Do this while still making the minimum payments on all other debts you owe.

- Once paid off take the money you had been paying on that first debt and contribute that (along with your minimum payment due) on your next debt with the next highest APR.

- Then repeat this as you move up your debts. You will notice your overall monthly debt payment across all debts does not change as you pay off each debt individually.

Why it works: This method works because it mathematically reduces the overall interest paid as you pay off your debts. It also has the same benefit as the snowball method of keeping your overall monthly debt payment even as you work down your debts.

Things to consider: Consider this method, especially if you have one or two very high-interest rate debts that are large, so they would not be addressed immediately with a method like the debt snowball. You may not see the motivational boost of a quick win if you start paying off a large debt with high interest first. However, you will save on overall interest paid using this method as compared to the debt snowball.

Saving and Investing

Investing in assets comes down to a very simple principle. In investing, the goal is to hold assets that both grow in their value on the open market and/or produce additional income over a period of time. This will be accomplished when the asset generally increases in value (gain) more than it decreases (loss) over a given period of time while also generating income, interest, or cash flow.

How an investment can produce value:

Appreciation: the overall value that you can sell the asset on the open market (ex., Stock market, real estate market, etc.), vs what you initially paid for it. The difference between these two (what you bought it for and what you sold it for is called capital gains.)

Income, Interest, or Cashflow: Assets such as stocks, or interest-bearing savings accounts, etc., will generate interest or dividends.

Compounding: The money paid back to you for holding the asset can generally be used to purchase more assets (re-investing or compounding), leading to accelerated growth.

Maximizing Reward and Reducing Risk

So, if the goal is to maximize the return on your investments and have them grow through compounding, how do you get the most return while minimizing the potential risk of loss?

This is essentially the entire goal and philosophy of managing your investments. While there is no silver bullet, you can use several key factors, considerations, and balancing strategies to help reduce your overall risk of loss while maximizing the greatest returns on your overall investment strategy.

These Are:

Time – How long until you need to sell your investment for its purpose, like retirement or a home down payment. Time horizon is crucial since investments are volatile and fluctuate over time. More time lets you ride out downturns instead of selling at a loss. The time available to reach your goal is key in determining the level of risk you should take.

Allocation – Asset allocation is key to managing investment risk. It defines how you divide investments among asset classes like stocks, bonds, cash, and real estate, each with varying risk levels. For example, what percentage is in stocks (higher risk) vs. fixed-income or cash (lower risk)?

Diversification – Diversification is more specific than asset allocation. It reduces portfolio risk by spreading investments across financial instruments, industries, sectors, and regions. This offsets losses from poorly performing investments with gains from others, minimizing volatility (large swings up and down). Allocation determines how much stock to own, while diversification decides which types of stocks to own.

Rebalancing – As the various investments within a well-allocated and diversified portfolio grow and change, your allocation mix may fluctuate until it no longer aligns with your target. Getting the mixture of investments back on target is a process called rebalancing, and it has another advantage to help increase your investment performance.

Investment rebalancing is the process of realigning a portfolio’s asset allocation to match its original or desired target allocation. Over time, due to differing performance across asset classes, a portfolio’s allocation can drift from its intended balance, potentially exposing the investor to higher risks or lower returns than intended. Rebalancing restores the portfolio to its intended risk-reward profile by moving money from one asset class to another, “rebalancing” the mixture to its target.

Dollar-Cost Averaging – Dollar-cost averaging (DCA) is an investment strategy where an individual invests a fixed amount of money at regular intervals, regardless of the asset’s price at the time of purchase. By spreading out the investment over time, DCA helps reduce the impact of market volatility, prevents loss of time in the market, and minimizes the risk of investing a large sum at an inopportune moment. DCA: Prevents you from trying to “time” the market and reduces emotional decision-making.

Reducing Risk

Tax

Consider How It Can Affect Your Plan. Utilize tax-efficient vehicles such as 403(b) and 529 savings plans for college savings.

Inflation

One of the key functions of investing is to overcome the erosion of the purchasing power of your savings and assets by inflation. Achieving returns on your investments (ROI) is not only used to grow the overall asset value of your portfolio but also used to fight the erosion of real purchasing power through inflation.

Ways to Compensate for Inflation:

Savings: Generally, savings accounts, while a safer investment, will produce returns that generally match or overcome inflation by only 1-2% during normal times. You will want to consider the effect on inflation when choosing how to save for the short term, in general savings accounts.

Inflation-Protected Securities (IPS): Some bonds or bond funds produce interest payments based on the current rate of inflation. They will generally pay more interest during higher levels of inflation in the economy. These are often called IPS or TIPS (treasury inflation-protected securities).

Stock Funds: Often, stocks perform well during high inflationary times due to investors moving into the market to compensate for the effects of inflation. Having a mix of diversified assets held in stocks or, better yet, stock funds, can be a way to outpace inflation within your portfolio.

Insurance

Types of insurance generally considered essential, depending on your circumstances: Health insurance, car insurance, homeowners insurance, auto insurance, term life insurance, flood insurance, disability insurance, workers’ comp insurance, and disability insurance.

ID Theft

The fastest-growing crime in the U.S. is identity theft, and it represents a significant threat to your financial plan. Identity theft is when someone illegally obtains a person’s personal information, such as their name, address, social security number, or other sensitive personal information. This information can be used to open new credit cards, drain bank accounts, and more. When someone steals your identity, it can often take years to fix the mess that is caused, often with significant effects on things such as your credit score.

As more and more financial transactions are done online, it is important to take precautions to help you avoid having your identity stolen or personal information compromised.

Ways to help Mitigate ID Theft Risk:

Protect Your Personal Information: When online, avoid sharing information that you may deem too sensitive or unnecessary for the transactions you are completing. Secure any physical documents containing private information and destroy them before disposing.

Secure your Online Accounts & Devices: Utilize security software on your devices, such as anti-virus and malware software. Run scans on your devices regularly and make sure the software on your devices is up to date. Use a VPN (Virtual Private Network) on your devices, especially if you are on public Wi-Fi. And update your online passwords regularly. Turn on 2FA (two-factor authentication) for sensitive accounts such as bank accounts.

Be Cautious & Monitor Your Information: Do not click on suspicious emails, which can often be phishing scams, and never open attachments that look suspicious. Before using a card reader, make sure to inspect the reader. Often, “skimmers” will be placed over card readers at gas stations or other locations that can collect your card information. Obtain a credit report for free from the major credit bureaus every few months to look for suspicious activity. Lock your credit with the different credit bureaus to prevent new account applications in your name.

Utilize Credit Monitoring Software: Credit monitoring software can be essential to protecting your ID, so we will dedicate the next slide to the options you have.

Having a Will

A will is a crucial legal document ensuring your assets, personal wishes, and dependents are taken care of after passing. Consult with an attorney. An estate planning attorney may be critical to building a will correctly, and is recommended.

If you would like to learn more about financial literacy for teachers and educators, consider our full-length course:

A Financial Literacy Mindset for Teachers

(24 PD Hours or 3 Semester Credits with Official Transcript) In this comprehensive course, you will learn the fundamentals of financial literacy, including money management, budgeting, debt reduction, investing, and planning for important financial goals in your life. Includes 20 templates, resources, & tools.

View the original article and our Inspiration here